About Corestar

Corestar Partners was founded in 2013, to provide innovative investment banking services, industry knowledge, relationships and senior level experience to leaders in the complex financial technology sector. We act as the mission critical independent advisor to founders, leading CEOs and industry decision makers covering the full spectrum of corporate finance services.

Corestar Partners tailors each engagement to provide superior corporate finance advice to founders, institutional or private investors on acquisitions, divestitures and recapitalizations in the financial technology industry. Our breadth of experience and deep domain expertise allow us to give bespoke, unconflicted advice to clients who need tailored solutions that maximize their value.

transactions

closed since inception

billion

aggregated closed transactions value since inception

cross border

transactions

Values

We are fully committed to deliver best results to our clients and partners as we work according to our values.

Experience

Corestar Partners has one of the most experienced Fintech deal teams in Europe. Its fully dedicated senior team is leading and executing all transactions, hands-on.

There is no separation between transaction execution, sector know-how and relationship management Most experienced sector focused execution team in Europe.

Corestar Partners’ senior team has a combined industry experience of over 60 years in the Fintech sector. Our firm’s partners have long-standing relationships with management and key decision makers of key strategic buyers and sponsors.

Network and Connectivity

Corestar Partners has an in-depth understanding of underlying market and competitive sector dynamics. Our unparalleled and on-going direct relationships with all relevant strategic buyers and sponsors through prior transactions and engagements provide an invaluable advantage in our advisory work.

Corestar Partners’ team has direct access to and deep insights across the entire global buyers’ universe. Our long-standing, close relationships with top management and key decision makers of key strategic buyers and sponsors are of critical importance navigating through complex transactions.

We engage an ongoing dialogue with all major Fintech focused private equity firms and family offices. This puts us in the position to find the best possible financial partner for funding the expansion of top-tier Fintech growth companies.

Our in-house Fintech database built over 15+ years of transactions allows for second to none analysis and knowledge of buyers’ behavior through each stage of the process.

Founders

HNWI

Financial Sponsors

Strategics

Geographic Coverage

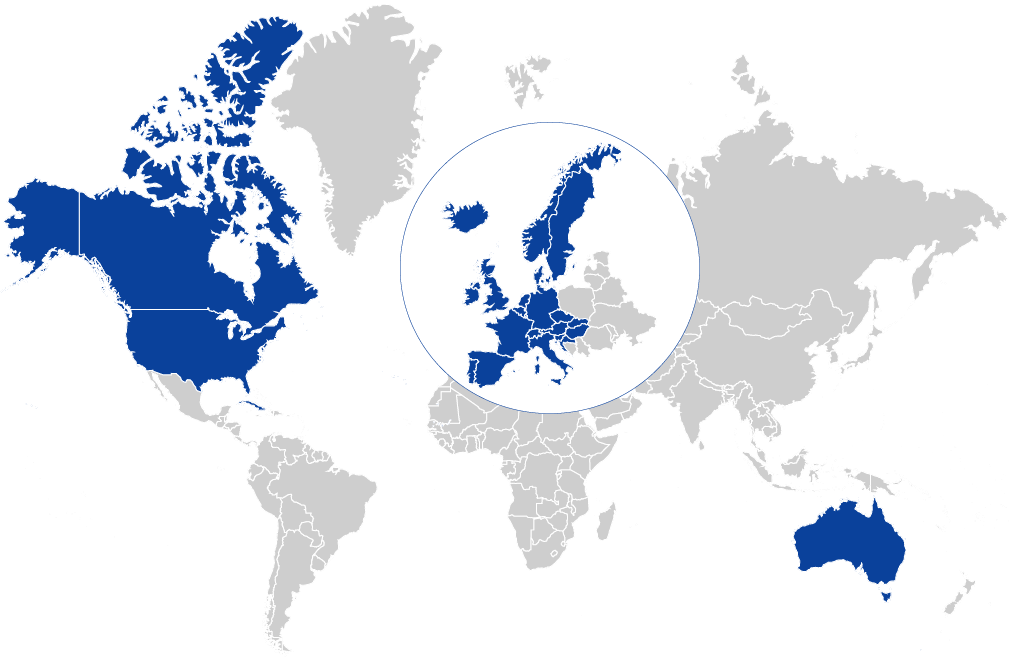

Headquartered in the heart of Europe, with local presence in Switzerland and the UK, our geographic focus is on the European Fintech ecosystem. With our global network among strategic and financial investors we focus on advising clients on projects across Europe and beyond.

To date, our team has advised clients in most European countries and the USA on diverse corporate finance projects. More than 60% of our transactions are cross-border transactions, underpinning our international reach and global network.

different client /

investor geographies

cross border

transactions actions

History

Corestar Partners was founded in 2013 with the vision to become the leading independent corporate finance advisory firm focused exclusively on the financial technology sector.

To date, the Corestar Partners’ senior team has advised clients across Europe on some of the most prominent transactions in the sector, having achieving landmark results for its clients on a repeat basis.

Through its long-lasting activity in advising and financing of Fintech companies, the team has built up an outstanding international network of financial and strategic investors as well as entrepreneurs and founders.

The exclusive focus on the financial technology sector provides us with a unique knowledge and experience of companies, investors and transactions within this highly complex and dynamic industry. This positioning combined with our track record of executing deals in the financial technology industry endows us to serve Fintech companies with national and international growth ambitions.